Offshore wind: Scotland’s bold ambitions on tenterhooks

In 2000, the Port of Nigg on Scotland’s east coast was a shell of its former self. A downturn in demand for the steel platforms fabricated at its yard for the North Sea oil and gas industry had led to thousands of job losses. The port was “a total mess” without any “proper roads”, recalls Steve Chisholm, director of operations and innovation at Global Energy Group (GEG), the engineering firm that has owned and operated Nigg since acquiring the port in 2011.

Nigg’s moss-covered quayside and old asbestos-ridden buildings, topped by seagulls’ nests and grass-covered roofs, symbolised the deprivation caused by market downturns in fossil fuel-dependent communities worldwide.

The port of Nigg before it was acquired and refurbished by Global Energy Group. Credit: Port of Nigg.

The port of Nigg before it was acquired and refurbished by Global Energy Group. Credit: Port of Nigg.

Today, the situation could not be more different. Following GEG’s £120m investment to refurbish the dilapidated port, it has begun to transition away from oil and gas. Reels of subsea cables sit in the shadow of turbine towers at least 100m high. Massive blades are laid out in rows next to nacelles that house the generating components for soon-to-be assembled offshore wind turbines.

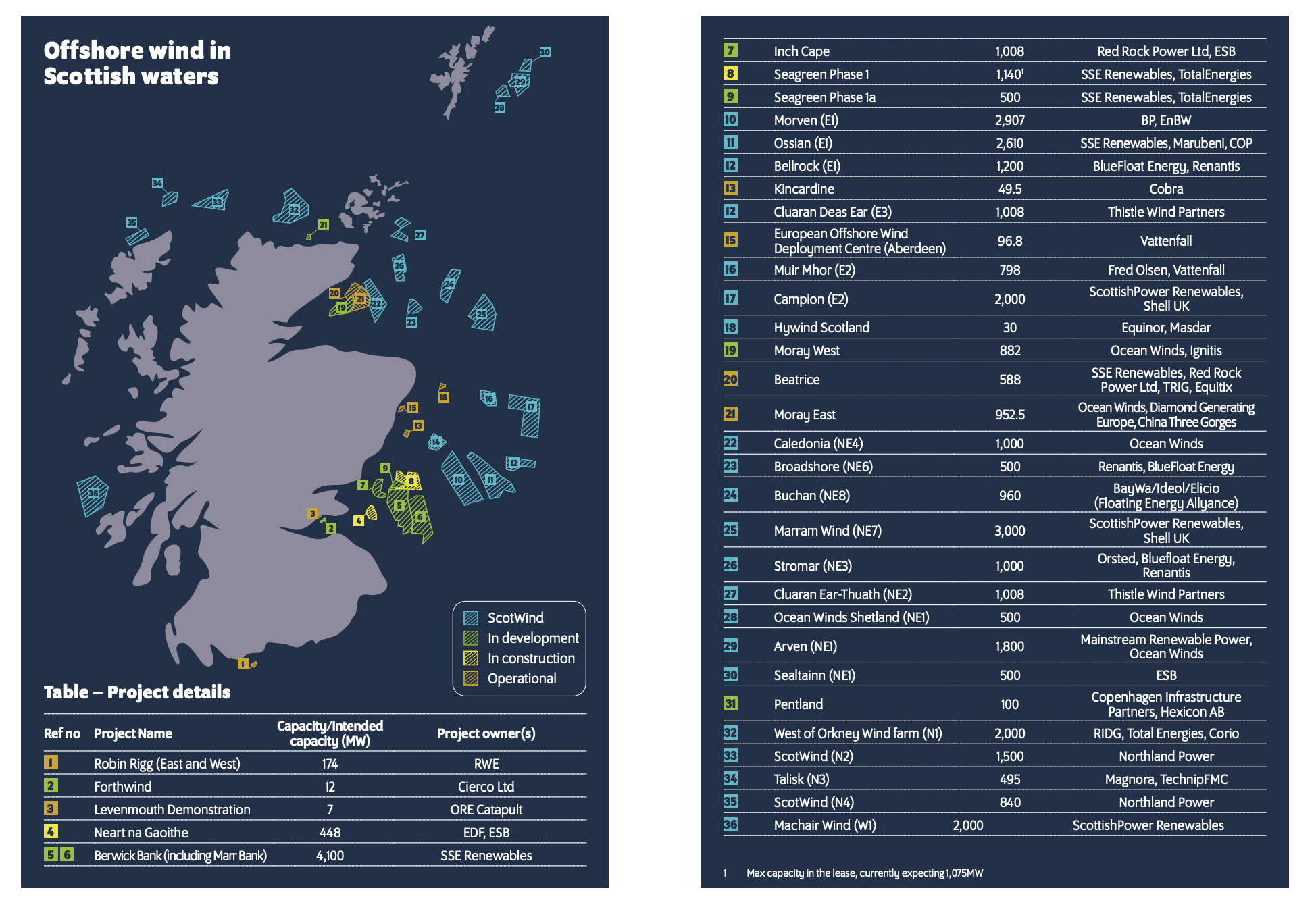

And this is only the beginning. Nigg, as well as the nearby ports of Inverness and Cromarty Firth, are located at the epicentre of the world’s most ambitious offshore floating wind programme. ScotWind, a leasing round for seabed rights to develop commercial-scale wind farms announced in 2022, has set in motion 20 offshore projects — 14 of which are floating — around the coast of Scotland and its northern islands of Lewis, Orkney and Shetland. ScotWind is run by Crown Estate Scotland, the public body that manages the country’s land and marine assets.

“The next frontier [of wind] is floating. This is an amazing clutch of projects for us to be able to take that world leadership role,” says Claire Mack, CEO of the trade body Scottish Renewables. Floating wind technology, which is less mature than ‘fixed-bottom’ turbines attached to shallow seabed near to the coast, has the potential to generate more power as turbines can be put in deeper waters where there tends to be stronger wind.

Claire Mack (pictured), CEO of Scottish Renewables, says that floating offshore wind is the next frontier for the renewables energy industry. Credit: Digital Triangle Creative/Scottish Renewables.

Claire Mack (pictured), CEO of Scottish Renewables, says that floating offshore wind is the next frontier for the renewables energy industry. Credit: Digital Triangle Creative/Scottish Renewables.

Developers that won ScotWind seabed rights are planning to build new wind generation capacity of up to 27.6 gigawatts (GW) over the next decade, estimated to be enough to power more than 14 million Scottish homes. The Scottish government hopes to attract manufacturers in the wind supply chain to its shores through favourable business conditions in recently granted Green Freeports: one called Opportunity Cromarty Firth around Nigg and Inverness, and another by the Firth of Forth near to the capital Edinburgh.

But Scotland’s daring plan faces numerous barriers. Developers tell fDi that Scotland’s port infrastructure needs to be massively expanded, the consent process for projects is too slow and there is a real risk of insufficient grid capacity for wind farms to connect by the early 2030s. A slew of challenges facing the global wind industry, including inflation, supply chain bottlenecks and loss-making turbine manufacturers, make timely delivery even more difficult.

Yet collaborative efforts between economic developers, businesses and academic institutions are underway to create the green jobs in rural and coastal communities that ScotWind could bring. In a lesson for the global transition away from oil and gas, Scotland is at the beginning of a renewables-driven economic transformation.

Blades for offshore wind turbines lined up at the port of Nigg. Credit: Crown Estate Scotland.

Blades for offshore wind turbines lined up at the port of Nigg. Credit: Crown Estate Scotland.

Reels of subsea cables at port of Nigg.

Reels of subsea cables at port of Nigg.

Sun shines through wind turbine towers at the port of Nigg. Credit: Crown Estate Scotland.

Sun shines through wind turbine towers at the port of Nigg. Credit: Crown Estate Scotland.

Scotland’s greatest economic opportunity

At the annual net-zero conference of Scotland’s renewable energy industry held in Edinburgh in March 2023, politicians voiced their excitement at the potential of ScotWind and the green transition. Richard Lochhead, Scotland’s former minister for the just transition, employment and fair work, hailed renewables as the “greatest economic opportunity” for the country of 5.5 million people.

“The 2020s are the lift-off decade for the green energy revolution in the same way that the 1780s were the lift-off decade for the industrial revolution,” he said. But he also underlined that ScotWind must deliver broad-based economic benefits to an energy-rich country with “one of the worst levels of fuel poverty in Europe”, referring to the many Scottish families unable to afford to heat their homes sufficiently.

Richard Lochhead says renewables offers the “greatest economic opportunity”. Credit: Digital Triangle Creative/Scottish Renewables.

Richard Lochhead says renewables offers the “greatest economic opportunity”. Credit: Digital Triangle Creative/Scottish Renewables.

Commitments are already in place. Scotland has attracted foreign direct investment (FDI) pledges worth billions of dollars from developers who were awarded seabed leasing rights in the ScotWind auction, and fDi Markets data indicates that last year the country attracted more wind FDI announcements than the rest of the world combined.

“We have opened the starting gates for projects around Scotland to be progressed,” says Colin Palmer, head of marine at Crown Estate Scotland. Under ScotWind agreements, developers are mandated to submit a supply chain development statement, which includes their minimum expenditure commitments in Scotland for the development, manufacturing and fabrication, installation and operation of their projects.

But the ScotWind process has faced criticism for underselling Scotland’s marine assets and not doing enough to ensure local supply chain development. While developers could lose their seabed leasing options if they fall below 25% of their minimum commitment, if they are between 25% and 90% they face a fine of only £250,000. In effect, this gives developers wiggle room to invest less in Scotland than they originally pledged and to import parts from abroad.

“We think that the level of fine is almost incentivising the breaking of these commitments,” says Craig Dalzell, head of policy and research at the think-tank Common Weal.

Map showing offshore wind blocks in Scottish waters. Credit: Crown Estate Scotland

Map showing offshore wind blocks in Scottish waters. Credit: Crown Estate Scotland

Despite this criticism, developers say ScotWind was made attractive in an incredibly competitive global market, in which many countries are holding seabed auctions to try to develop their offshore wind industries.

Chelsea Nickles, head of market development in the UK and Ireland at Danish developer Ørsted, says the focus on “non-price factors” such as supply chain development in ScotWind is going to lead to a “more robust industry that is able to deliver” on these projects.

“Scotland has been incredibly innovative in its approach to offshore seabed leasing,” she says, citing the Innovation and Targeted Oil & Gas auction. A leasing round separate to ScotWind, it was the world’s first auction designed to enable offshore wind to directly supply oil and gas platforms.

Chelsea Nickles of Orsted says Scotland has been “incredibly innovative” in its approach to offshore seabed leasing. Credit: Digital Triangle Creative/Scottish Renewables.

Chelsea Nickles of Orsted says Scotland has been “incredibly innovative” in its approach to offshore seabed leasing. Credit: Digital Triangle Creative/Scottish Renewables.

Mr Palmer says the aim of the auction is to act as a “stepping stone” for ScotWind, where developers can experiment with new approaches to reduce the cost and enable larger-scale offshore wind deployment. Of the 13 Intog projects awarded in March 2023, eight are to decarbonise oil and gas platforms, while the remaining five focus on small-scale innovative offshore wind projects of less than 100 megawatts.

Richard Sanford is vice president of energy major BP’s UK offshore wind business, which was awarded one of the innovation projects under Intog in March 2023. He says this will enable the company to develop its first floating offshore wind demonstration project.

After winning a ScotWind bid in January 2022, BP plans to build a 2.9GW project with Germany’s EnBW in a 860 square-kilometre lease area off the coast of Aberdeen, the UK’s home of oil and gas. The British energy major said it expects this bid to unlock up to £10bn of investment in offshore wind development, skills and opportunities in hydrogen and electric vehicle charging.

The myriad challenges facing ScotWind

While the potential for ScotWind is huge, there needs to be a lot of troubleshooting for these projects to become a reality. Ms Mack at Scottish Renewables says the incentives offered by the US Inflation Reduction Act and the EU make the competition an uphill battle. “[The UK] is squeezed in the middle between those two,” she says. “We really need to get on top of [labour and construction cost inflation] in order to de-risk these projects and make the UK a really attractive place for private investment.”

The opportunity for supply chain development could be enormous for Scotland, given that there could be as many as 1500 turbines being installed offshore over the next decade. However, the manufacturing, assembly, integration, operation and maintenance activities needed at deepwater ports for the planned offshore wind projects will also require billions in investment.

The Port of Cromarty Firth, which along with Nigg and Inverness was recently granted Green Freeport status, is aiming to double its capacity through a £200m expansion. Joanne Allday, a strategic business development manager at the port, says infrastructure needs to be developed now to build out wind capacity at pace and meet the UK offshore wind industry’s 2019 commitment to achieve 60% local content by 2030.

“If we don’t start now, it will never be ready,” she says. “The challenge we have with funding infrastructure on this scale is the developers can’t give you the money because they haven’t reached financial close [on their projects].”

Port of Cromarty Firth CEO Bob Buskie likens the complexity of the current “impasse” to trying to align holes in different layers of Gruyère cheese: “The layers of legislation and opportunity [presented by ScotWind] can’t quite seem to come together.”

Beyond port infrastructure, many wind developers have not yet received any confirmation of connection to the grid for their ScotWind projects, with no certainty over when this will happen. National Grid, the UK’s electricity system operator, is currently undergoing the “holistic network design” process of working out how to connect 23GW of offshore wind by 2030.

“Issues arise when a developer faces a late grid connection, as that pushes back project schedules and commissioning dates, resulting in additional costs,” says Jean Lewis, export energy capacity lead at Thistle Wind Partners. The company is developing two ScotWind projects, one floating and one fixed-foundation, with a total capacity of 2GW.

Given the queue of already constructed onshore wind projects awaiting connection, industry experts at the net-zero conference in Edinburgh called for an acceleration of the planning process to meet the scale of transmission investment needed. Ms Lewis adds that these grid challenges will have the knock-on effect of delaying developers’ fulfilment of supply chain commitments.

Stemming brain drain from the Highlands

The large-scale deployment of offshore wind that lies ahead for Scotland is already being incorporated by local stakeholders looking to turn it into a bigger opportunity for the whole economy.

At the University of Highlands and Islands (UHI) campus outside Inverness, local authorities aim to stem the brain drain of young people by providing sustainable local job opportunities in the renewables sector. A 2018 report found that just 17% of the rural Highlands and Islands region’s population were aged 15–30, below the national average of 21%. It noted that “outmigration of young people has a significant impact on the overall population size, on community sustainability, and on the possibilities for economic growth”.

Alison Wilson, director of alumni engagement at UHI, says young people’s attitudes have changed recently. She adds that ScotWind and the entry of global companies have given the younger generation more reasons to stay in the region, whereas in the past they would have moved south to study and work in larger cities such as Glasgow and Edinburgh.

“More than three decades ago, I myself had to leave the region,” she says. “We are turning the tide now. I’m starting to see a change in our young people with their own confidence in the region.”

Through partnerships with ScotWind developers and other organisations, UHI has developed a science, technology, engineering and maths outreach programme. It aims to engage and inspire local schoolchildren about future renewables opportunities, alongside workforce development for the roughly 3000 students graduating from UHI each year.

Developers underline the importance of these efforts. The biggest challenge is “ensuring that we have people with the right skills to participate in the local supply chain as the 27GW of ScotWind capacity enters construction,” says Ian Taylor, project director at Thistle Wind Partners.

Avoiding the previous perils of oil and gas

The fundamental goal of local Scottish economic developers is to avoid the perils of oil price downturns and the shutting down of yards that previously led to job losses and deprivation in many rural and coastal communities. “We’re really keen to learn lessons from the past and for this new energy coming forward to avoid that boom and bust,” says Audrey MacIver, director of energy and low carbon at the Highlands and Islands Enterprise economic development agency.

With renewables come more consistent and sustainable jobs. While oil and gas rigs are typically highly engineered and complex one-of-a-kind structures, offshore wind farms rely on hundreds of the same components, and local authorities say the thousands of offshore wind turbines will also create jobs in operations and maintenance support over their 30-year lifespan.

Scotland has already attracted some of the wind supply chain, including a commitment in February 2023 from Singapore manufacturer Mooreast to set up a facility for offshore wind related projects in Aberdeen. Mr Chisholm at GEG says the Port of Nigg is in discussions to partner on the manufacture of offshore wind towers, and has had significant interest from anchor and high-voltage subsea cable companies.

A big focus of the strategy for ScotWind is on wind turbine components, where there are gaps in global capacity, according to Simon Wallace, a senior energy manager at Scottish Development International. This includes cables, anchors and the substructures used in floating wind projects, which are so heavy that it is better to produce them locally rather than transport them.

At the Port of Nigg, where an oil terminal on a 75-acre site is being decommissioned for its new life as a green energy hub, Mr Chisholm is optimistic. Despite the change in “mindset and equipment manufacturing process” needed for the transition from one-off oil and gas rig designs to mass production for renewables, he believes there is a “huge opportunity” for the development of a manufacturing base.

“Even though the UK and Scotland cannot get to a point where we can competitively manufacture every single component, there’s no point in building these structures on the other side of the world,” he says, adding that the polluting transportation journey can cause damage.

The environmental dividend of switching from oil rigs to wind turbines can be sizable for Scotland. But development dividend, in the forms of jobs and a flourishing value chain, is not a foregone conclusion.